ir.term_structure package¶

ir.term_structure.bootstrap module¶

bootstrap module

-

class

ir.term_structure.bootstrap.Bootstrap(input_helper)¶ Bases:

objectBootstrap class

Examples

- Input set-up

‘bootstrap_input.json’ file is located at ir/term_structure/test

>>> helper = bootstrap_input_helper.extract_json('bootstrap_input.json', is_print=False) 2016-05-26 15:16:31 WARNING Valuation date is changed to [March 8th, 2010] >>> val_date = helper[0] >>> sim_year = 5 >>> schedule = ql.Schedule(val_date, val_date + ql.Period(sim_year, ql.Years), ql.Period(1, ql.Months), ql.UnitedStates(), ql.Following, ql.Following, ql.DateGeneration.Forward, False)

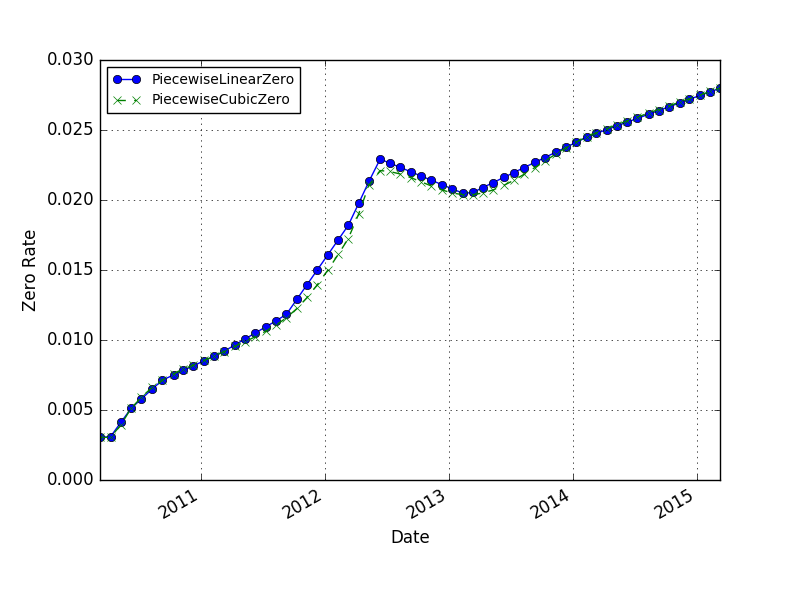

- Bootstrap by linear and cubic interpolation on zero rates

>>> curve_linear = PiecewiseLinear(helper) >>> zero_linear = curve_linear.get_zero(list(schedule)) >>> curve_cubic = PiecewiseCubic(helper) >>> zero_cubic = curve_cubic.get_zero(list(schedule)) >>> curves.plot('zero', val_date, {**zero_linear, **zero_cubic})

-

piecewise_cubic(daycount=<DayCount.ActAct: <QuantLib.QuantLib.ActualActual; proxy of <Swig Object of type 'QuantLib::ActualActual *' at 0x000000000696E1B0> >>)¶ Interpolate based on piecewise cubic for zero rate Valuation date is set as same as settle date defined during input_helper

Parameters: daycount (ir.date_time.enum.DayCount) – Daycount; default: DayCount.ActAct Returns: bootstrapped curve object. Return type: ir.term_structure.curves.Curve

-

piecewise_linear(daycount=<DayCount.ActAct: <QuantLib.QuantLib.ActualActual; proxy of <Swig Object of type 'QuantLib::ActualActual *' at 0x000000000696E1B0> >>)¶ Interpolate based on piecewise linear for zero rate Valuation date is set as same as settle date defined during input_helper

Parameters: daycount (ir.date_time.enum.DayCount) – Daycount; default: DayCount.ActAct Returns: bootstrapped curve object. Return type: ir.term_structure.curves.Curve

-

piecewise_log_cubic_discount(daycount=<DayCount.ActAct: <QuantLib.QuantLib.ActualActual; proxy of <Swig Object of type 'QuantLib::ActualActual *' at 0x000000000696E1B0> >>)¶ Interpolate based on piecewise log cubic for discount rate Valuation date is set as same as settle date defined during input_helper This is what QuantLib recommended but it failed on convergence. QuantLib-Python does not have access to change the convergence.

Parameters: daycount (ir.date_time.enum.DayCount) – Daycount; default: DayCount.ActAct Returns: bootstrapped curve object. Return type: ir.term_structure.curves.Curve

ir.term_structure.bootstrap_input_helper module¶

-

ir.term_structure.bootstrap_input_helper.deposit(settle, rate, tenor, daycount=<DayCount.Act360: <QuantLib.QuantLib.Actual360; proxy of <Swig Object of type 'QuantLib::Actual360 *' at 0x000000000696E0F0> >>, val_date=None)¶ Input rate from deposit

Parameters: - settle – Settlement date. I assume valuation date is same as settlement date

- rate – Annualized rate in list (in decimal format)

- tenor – Maturity in ql.Period

- daycount – Use date_time.ir.DayCount enum (Default: DayCount.Thirty_360)

- val_date (ql.Date) – Valuation date (Default: None to set same as settle)

Returns: tuple contains:

- settle (ql.Date): Settle date

- helper (list): q.DepositRateHelper

Return type:

-

ir.term_structure.bootstrap_input_helper.extract_json(json_file, is_print=False)¶ The json file is for the most widely used inputs for US market. Input types are deposit, eurodollar future, and interest rate swap on Libor 3M

If different inputs need to be implemented then directly use helpers above.

Parameters: - json_file – json file name

- is_print – print in console; default to False

tuple: tuple contains:

- settle (ql.Date): Settle date

- helper (list): helper for bootstrapping

-

ir.term_structure.bootstrap_input_helper.future(settle, rate, mat_date, daycount=<DayCount.Act360: <QuantLib.QuantLib.Actual360; proxy of <Swig Object of type 'QuantLib::Actual360 *' at 0x000000000696E0F0> >>, convexity_adj=<QuantLib.QuantLib.QuoteHandle; proxy of <Swig Object of type 'std::vector< Handle< Quote > >::value_type *' at 0x000000000A97C5A0> >, months=3, val_date=None)¶ The default setting is for Eurodollar future.

Parameters: - settle – Settle date in ql.Date

- rate – Rate

- mat_date – Maturity date in ql.Date, QuantLib checks for the eligible eurodollar future date

- daycount – Act / 360

- convexity_adj – convexity adjustment; Default to 0.0

- months – Libor month; Default to 3 month

- val_date (ql.Date) – Valuation date (Default: None to set same as settle)

Returns: tuple contains:

- settle (ql.Date): Settle date

- helper (list): ql.FutureRateHelper

Return type:

-

ir.term_structure.bootstrap_input_helper.swap(settle, rate, tenor, fixed_freq=<Freq.Semiannual: 2>, fixed_daycount=<DayCount.Act360: <QuantLib.QuantLib.Actual360; proxy of <Swig Object of type 'QuantLib::Actual360 *' at 0x000000000696E0F0> >>, floating_index=<QuantLib.QuantLib.USDLibor; proxy of <Swig Object of type 'USDLiborPtr *' at 0x000000000A97C570> >)¶ This is assuming USD Libor swap

Parameters: - settle – Settle date

- rate – (par) swap rate

- tenor – swap tenor in ql.Period

- fixed_freq – Fixed leg payment frequency; Default to semiannual

- fixed_daycount – Act / 360 based on Matlab and following specification

- floating_index – Floating leg rate index: Assuming Libor swap Default: ql.USDLibor(ql.Period(‘3M’))

Returns: tuple contains:

- settle (ql.Date): Settle date

- helper (list): ql.SwapRateHelper

Return type:

ir.term_structure.curves module¶

curves module

Examples

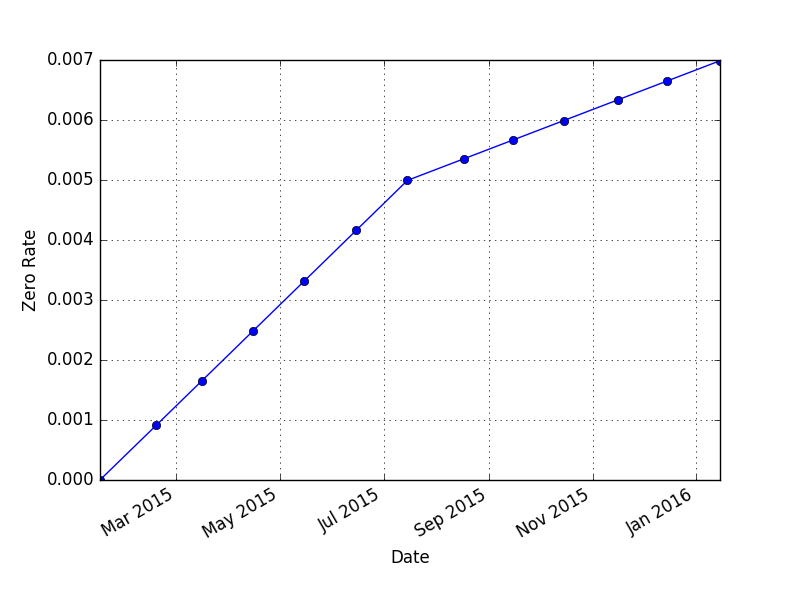

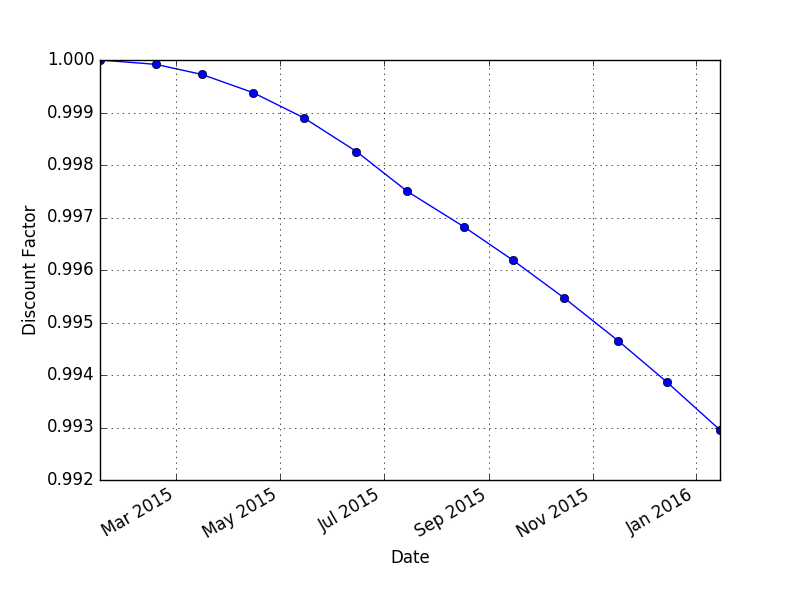

- Get spot rate and discount factor

>>> val_date = ql.Date(15, 1, 2015)

2016-05-26 15:28:48 WARNING Valuation date is changed to [January 15th, 2015]

>>> schedule = ql.Schedule(ql.Date(15, 1, 2015), ql.Date(15, 1, 2016), ql.Period(1, ql.Months), ql.UnitedStates(), ql.Following, ql.Following, ql.DateGeneration.Forward, False)

>>> spot_curve = SpotCurve(val_date, [ql.Date(15, 1, 2015), ql.Date(15, 7, 2015), ql.Date(15, 1, 2016)], [0.0, 0.005, 0.007])

>>> zeros = spot_curve.get_zero(list(schedule))

>>> curves.plot('zero', val_date, zeros)

>>> spot_curve.get_discount_factor(list(schedule))

>>> curves.plot('discount', val_date, df)

See also

-

class

ir.term_structure.curves.Curve(settle, val_date=None)¶ Bases:

objectBase class for all term_structure curve

-

curve¶ ir.term_structure.curves.Curve object

Implement this in super class

-

curve_name¶ Implement this in super class

-

get_discount_factor(sim_ql_date, daycount=<DayCount.Act360: <QuantLib.QuantLib.Actual360; proxy of <Swig Object of type 'QuantLib::Actual360 *' at 0x000000000696E0F0> >>)¶ Get discount factor

Parameters: - sim_ql_date (list) – simulate date

- daycount (ir.date_time.enum.DayCount) – Default: DayCount.Act360 or value set by __init__

Returns: {curve_name: pandas.DataFrame with ‘Date’, ‘Rate’ column}

Return type:

-

get_forward(sim_ql_sdate, sim_ql_edate, daycount=None, compounding=None, freq=None)¶ Get forward rate

Parameters: - sim_ql_sdate (ql.Date) – Start date

- sim_ql_edate (ql.Date) – End date

- daycount (ir.date_time.enum.DayCount) – Default: DayCount.Act360 or value set by __init__

- compounding (ir.date_time.enum.Compounding) – Default: Compounding.Compounded or value set by __init__

- freq (ir.date_time.enum.Freq) – Default: Freq.Semiannual or value set by __init__

Returns: {curve_name: pandas.DataFrame with ‘Date’, ‘Rate’ column}

Return type:

-

get_zero(sim_ql_date, daycount=None, compounding=None, freq=None)¶ Get zero (spot) rate Unlike Matlab, extrapolation does not work for the shorter tenors. It only works on longer tenors

Parameters: - sim_ql_date (list) – simulate date

- daycount (ir.date_time.enum.DayCount) – Default: DayCount.Act360 or value set by __init__

- compounding (ir.date_time.enum.Compounding) – Default: Compounding.Compounded or value set by __init__

- freq (ir.date_time.enum.Freq) – Default: Freq.Semiannual or value set by __init__

Returns: {curve_name: pandas.DataFrame with ‘Date’, ‘Rate’ column}

Return type:

-

-

class

ir.term_structure.curves.FlatForward(settle, forward_rate, daycount=<DayCount.Act360: <QuantLib.QuantLib.Actual360; proxy of <Swig Object of type 'QuantLib::Actual360 *' at 0x000000000696E0F0> >>, compounding=<Compounding.Compounded: 1>, compound_freq=<Freq.Annual: 1>, val_date=None)¶ Bases:

ir.term_structure.curves.CurveFlatForward class This is used for curve construction without bootstrapping

Examples

>>> val_date, maturity_date = ql.Date(5, 1, 2010), ql.Date(5, 1, 2014) >>> schedule = ql.Schedule(val_date, maturity_date, ql.Period(ql.Quarterly), ql.NullCalendar(), ql.Unadjusted, ql.Unadjusted, ql.DateGeneration.Forward, False) >>> flat_forward_curve = FlatForward(val_date, 0.1, compound_freq=Freq.Quarterly) >>> forwards = flat_forward_curve.get_forward(list(schedule), [schedule_ele + ql.Period('3M') for schedule_ele in list(schedule)], freq=Freq.Quarterly)

-

curve¶ Returns curve instance

Returns: ql.FlatForward(...)

-

curve_name¶ Returns curve name

Returns: str: ‘FlatForward’

-

-

class

ir.term_structure.curves.PiecewiseCubic(input_helper, daycount=<DayCount.ActAct: <QuantLib.QuantLib.ActualActual; proxy of <Swig Object of type 'QuantLib::ActualActual *' at 0x000000000696E1B0> >>, val_date=None)¶ Bases:

ir.term_structure.curves.PiecewiseCurveInterpolate based on piecewise cubic for zero rate

-

curve¶ Returns curve instance

Returns: ql.PiecewiseCubicZero(...)

-

curve_name¶ Returns curve name

Returns: str: ‘PiecewiseCubic’

-

-

class

ir.term_structure.curves.PiecewiseCurve(input_helper, daycount=<DayCount.ActAct: <QuantLib.QuantLib.ActualActual; proxy of <Swig Object of type 'QuantLib::ActualActual *' at 0x000000000696E1B0> >>)¶ Bases:

ir.term_structure.curves.CurveBase class for curve constructed by bootstrap Valuation date is set as same as settle date defined during input_helper

See also

-

curve¶

-

curve_name¶

-

-

class

ir.term_structure.curves.PiecewiseLinear(input_helper, daycount=<DayCount.ActAct: <QuantLib.QuantLib.ActualActual; proxy of <Swig Object of type 'QuantLib::ActualActual *' at 0x000000000696E1B0> >>, val_date=None)¶ Bases:

ir.term_structure.curves.PiecewiseCurveInterpolate based on piecewise linear for zero rate

-

curve¶ Returns curve instance

Returns: ql.PiecewiseLinearZero(...)

-

curve_name¶ Returns curve name

Returns: str: ‘FlatForward’

-

-

class

ir.term_structure.curves.PiecewiseLogCubicDiscount(input_helper, daycount=<DayCount.ActAct: <QuantLib.QuantLib.ActualActual; proxy of <Swig Object of type 'QuantLib::ActualActual *' at 0x000000000696E1B0> >>)¶ Bases:

ir.term_structure.curves.PiecewiseCurveInterpolate based on piecewise log cubic for discount rate Valuation date is set as same as settle date defined during input_helper

-

curve¶ Returns curve instance

Returns: ql.PiecewiseLogCubicDiscount(...)

-

curve_name¶ Returns curve name

Returns: str: ‘PiecewiseLogCubicDiscount’

-

-

class

ir.term_structure.curves.SpotCurve(settle, spot_date, spot_rate, daycount=<DayCount.Act360: <QuantLib.QuantLib.Actual360; proxy of <Swig Object of type 'QuantLib::Actual360 *' at 0x000000000696E0F0> >>, compounding=<Compounding.Compounded: 1>, compound_freq=<Freq.Annual: 1>, val_date=None)¶ Bases:

ir.term_structure.curves.CurveSpotCurve class This is used for curve construction without bootstrapping

-

curve¶ Returns curve instance

Returns: ql.ZeroCurve(...)

-

curve_name¶ Returns curve name

Returns: str: ‘Spot’

-

-

ir.term_structure.curves.plot(rate_type, val_date, rate_dict, title=None, x_label=None)¶ Parameters: - rate_type (str) – either ‘zero’, ‘forward’, ‘discount’

- val_date (ql.Date) – Valuation date

- rate_dict (dict) – dictionary with {curve_name: rates) rates are generated by ir.term_structure.curves.Curve.get_zero / get_forward / get_discount_factor

- title (str) – title string (Default: None)

- x_label (str) – x label name (Default: None to be ‘Date’, other options are ‘day’, ‘year’)